In our conversations about long-term stock investing, the overwhelming goal of many of our users is to retire a millionaire. Even if a million is not quite enough (or perhaps far more than enough) for some eventually-retirees, the lure of the 7-figure mark seems too great. That’s why we created our retirement calculator, an interactive infographic that will help you see where your current investing patterns will result on retirement.

We wanted to share some examples of what it would look like to retire as a millionaire, comparing the amount of savings required to hit the mark versus stock investments.

TIP: When looking far into your financial future, you may find our previous article useful: What does success look like? 3 Questions to Answer when Choosing Your Investing Goals

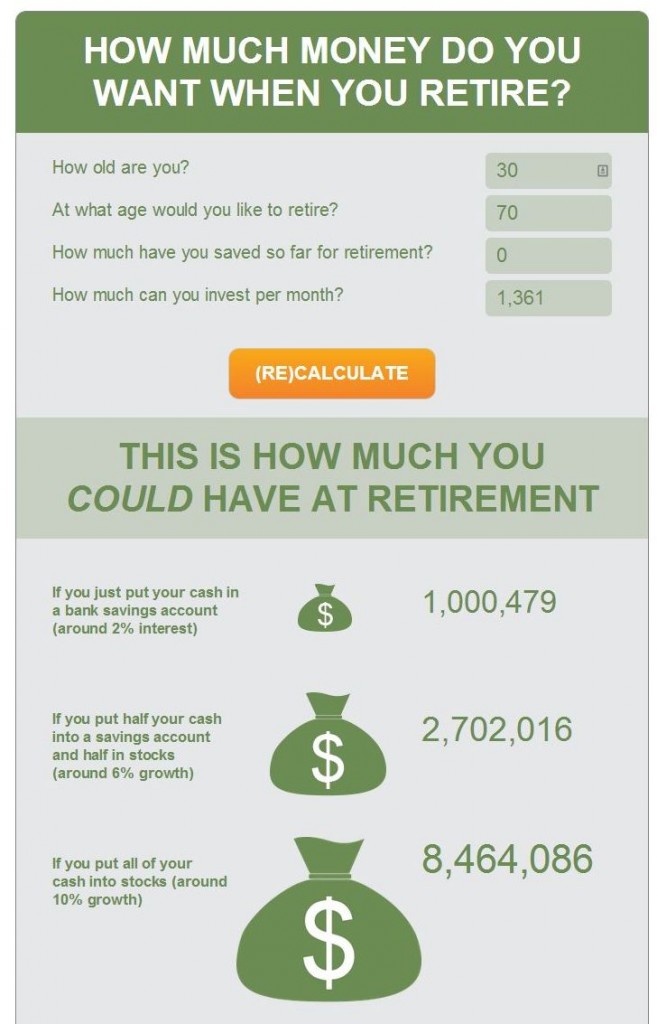

Scenario 1: Age 30, No Retirement Savings

Have virtually no retirement savings and just starting on your long-term investing journey? No problem. Take a look below at two basic calculations, both assuming age 30 with no retirement savings. In this case, we’re predicting age 70 for retirement.

As you can see from the above, if you are age 30 now and have no retirement savings, you’ll need to invest approximately $1,361 dollars a month, from now until age 70, if you are only going to stock your money away in a savings account.

Seems like a stretch? Perhaps. However, if you choose to invest in stocks instead, your long-term investment will only need $161 a month – quite the difference. Even if you chose to split that $161 between stocks and savings, you’d still end up with more than twice as much retirement money than just the bank savings account.

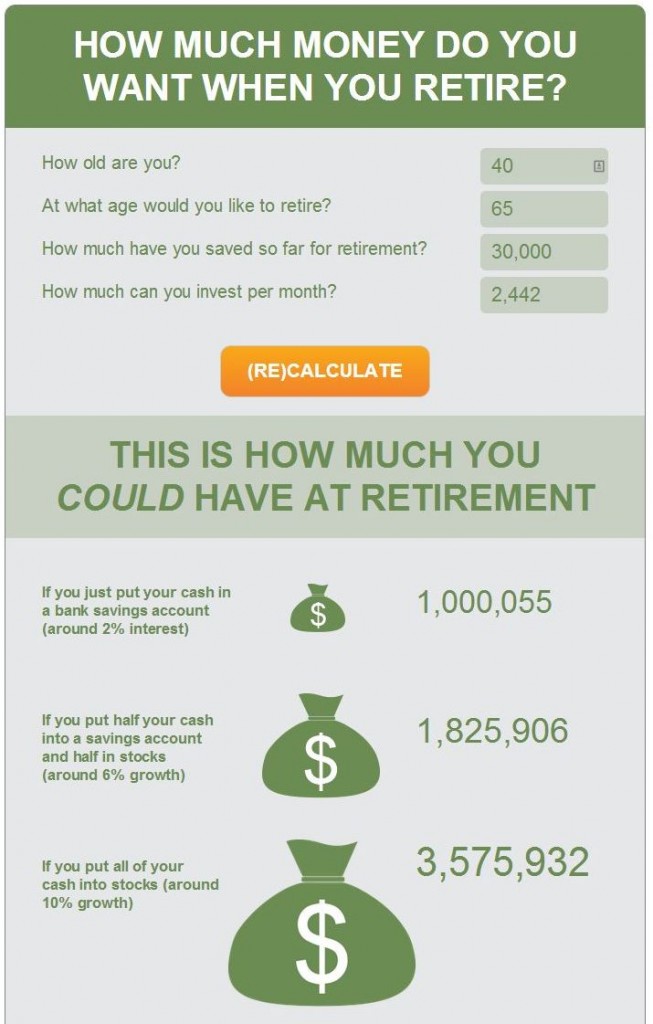

Scenario 2: Age 40, A Bit of Retirement Savings

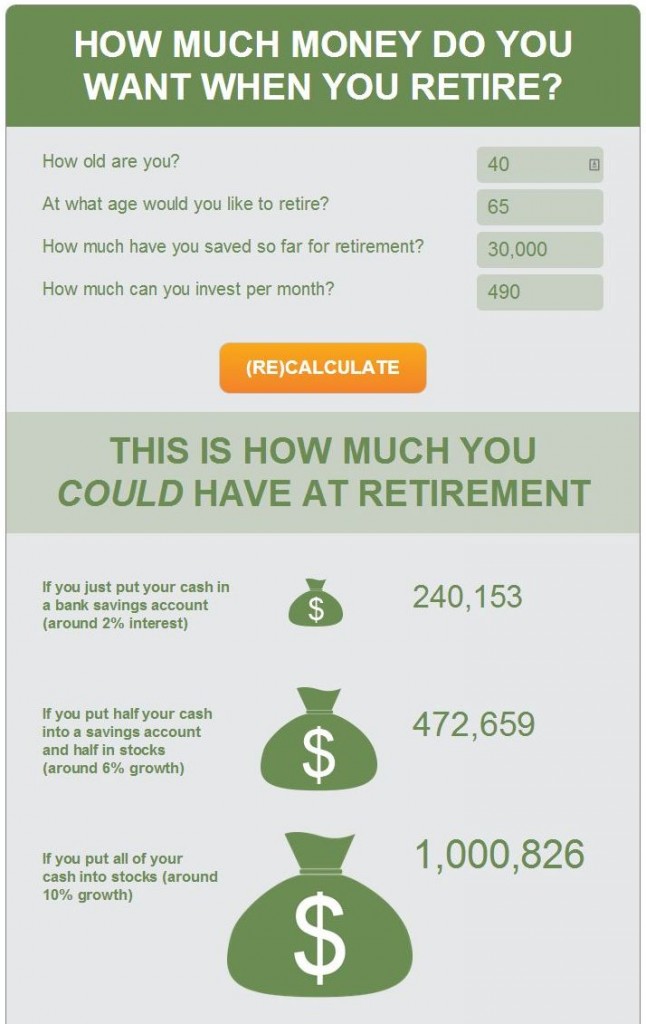

Let’s try another scenario. Let’s say you’re in your 40s and do have some retirement savings built up ($30k in our example). You’re a decade further into your retirement than the first scenario, but already have savings established. We’re also giving you a break with retirement at 65. How do the calculations for millionaire status play out?

Looking at the numbers, again we see what a difference a stock component makes in comparison to bank savings. In this case, to become a millionaire in the years between 40 and 65, you need to be saving $2,442/month if you’re just putting it into savings. That’s quite a bit, we have to say!

If you include a stock component, you only need to put away a much more reasonable $490/month to hit the million dollar mark.

Check Your Own Scenarios

We encourage you to check out our retirement calculator and figure out how the numbers play out for you. Try a few combinations, and track your results. The calculator is available 24 hours a day, 7 days a week, so bookmark it, share it, and then adjust your investing habits if you don’t like the numbers you see.

Friendly Reminder: We can’t predict the future, but we can make an educated guess. We use historical economic figures to average out an estimate of how much the market will gain in the future. Calculations assume quarterly compounding of interest. From January 1970 through the end of 2012, the average annual compounded rate of return for the S&P 500®, including reinvestment of dividends, was approximately 10.1%. (source: www.standardandpoors.com)

Use these estimates as just that-an estimate. We do not guarantee returns.